Volvo Cars’ Electrified Future

Dirk Caspary

3/18/2021

All good things come to an end, and with respect to internal combustion engines for cars, all good things must come to an end. It is unimaginable how the world would look today if cars with internal combustion engines were not invented almost 150 years ago. Just think of all your family trips!

Anyhow, the environmental impact of cars is eventually acknowledged, and car manufacturers adapt with innovative technologies. Like Volvo cars, which announced that it “is committed to becoming a leader in the fast-growing premium electric car market and plans to become a fully electric car company by 2030“.

For most of the time, cars were powered by internal combustion engines until the 1990s when hybrid electrical vehicles emerged. But hybrid engine technologies are much older than that: Submarines have used hybrid engines for a long time or have a look at this US patent US409116. Then, about a couple of years, electric cars emerge as well, whereas the first rough version of the electric car was invented in the 1830s.

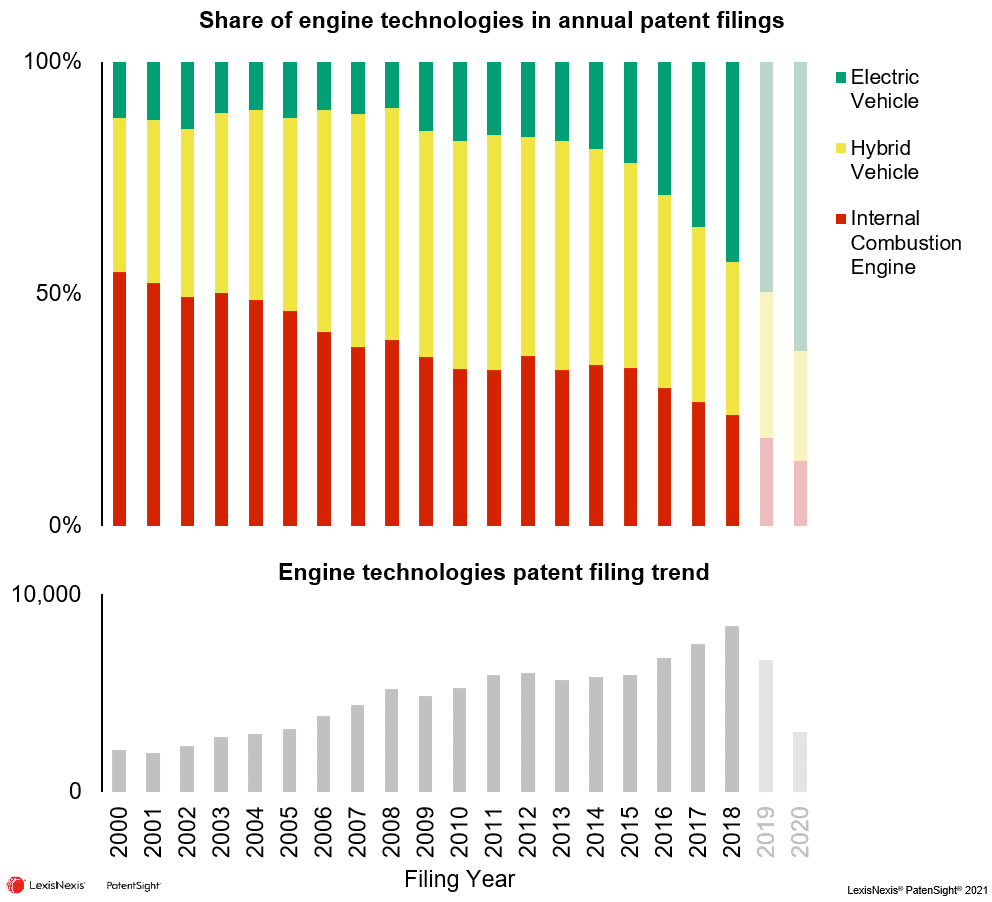

To analyze the transition from internal combustion engines over hybrid vehicles to electric vehicles, we defined the three technology fields “internal combustion engines”, “hybrid vehicles”, and “electric vehicles”. The analysis was conducted using LexisNexis® PatentSight®, a proprietary patent analytics solution. The upper portion of the chart shows the relative distribution of patent filings between internal combustion engines, hybrid vehicles, and electric vehicles. The lower portion shows the actual patent filing trend across the three technologies fields. Please note that not all filings from 2019 and 2020 may be published yet due to the patent prosecution process.

The transition from internal combustion engines over hybrid vehicles to electric vehicles is clearly visible in the patent filing trend. The share of internal combustion engine patent filings declined over the last 20 years. In contrast, the patent filings for electric vehicles continuously increased, whereas the hybrid patent filings increased first, and has started to decline since about 2010.

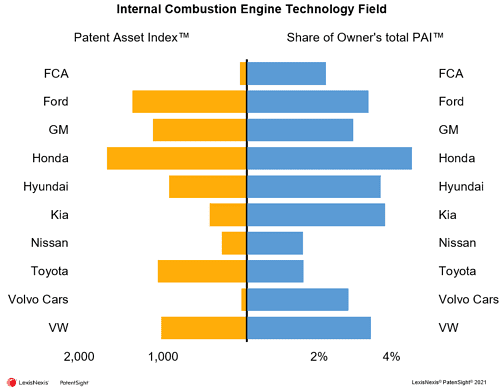

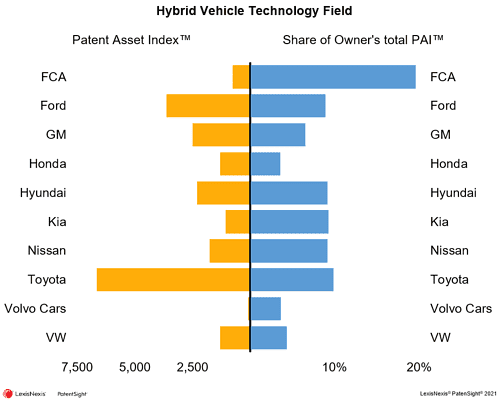

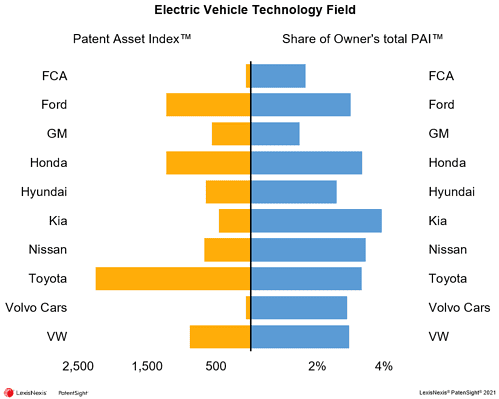

To put Volvo Cars’ engine intellectual property into context, a set of car manufacturers was selected from the world’s largest car manufacturers based on vehicle production. For each car manufacturer and engine technology, we determined two measures: the manufacturer’s patent portfolio strength (Patent Asset Index) in the engine technologies, and the relative contribution of the technology field to the car manufacturer’s total patent portfolio strength.

The overall picture supports the finding of a transition from internal combustion engines to electric vehicles. The average portfolio strength of the car manufacturers is highest for the hybrid vehicle technology field, and about equal for the internal combustion engine and electric vehicle technology fields. The same overall trend applies to the average share of the technology fields contributing to the car manufacturers’ overall patent portfolio strength.

In the internal combustion engine technology field, Ford, General Motors, and Honda Motors are the patent owners with the strongest portfolios. Considering the share which the patents from the internal combustion engine technology field contribute to the patent portfolio strength of its owners, Hyundai, Honda, and Kia are the top three patent owners. Volvo Cars has, in comparison, the least patent portfolio strength in the internal combustion engine technology field.

In the hybrid vehicles technology field, Toyota has the strongest portfolio among the selected manufacturers. It is also the strongest portfolio of all three technology fields in absolute terms. Further, Fiat Chrysler Automobiles (FCA) hybrid vehicle technology field patents contribute about 20% to the company’s total patent portfolio’s strength which is the highest share among its peers. Volvo Cars, again, has the least patent portfolio strength in the technology field.

In the electric vehicle technology field, Toyota has the strongest technology field portfolio, but more remarkable is that Kia Motors’ electric vehicle technology field has the highest share of the companies’ total portfolio strengths. Again, Volvo Cars rank at the last among its peers.

Thus, it appears that Volvo Cars’ goal is overly ambitious from today’s patent perspective. However, considering that 2030 is still nine years ahead, which is about 1.5 times the average age of an active patent family as of today, a lot may change. A trend analysis may provide a reference for forecasting future of Volvo Cars.

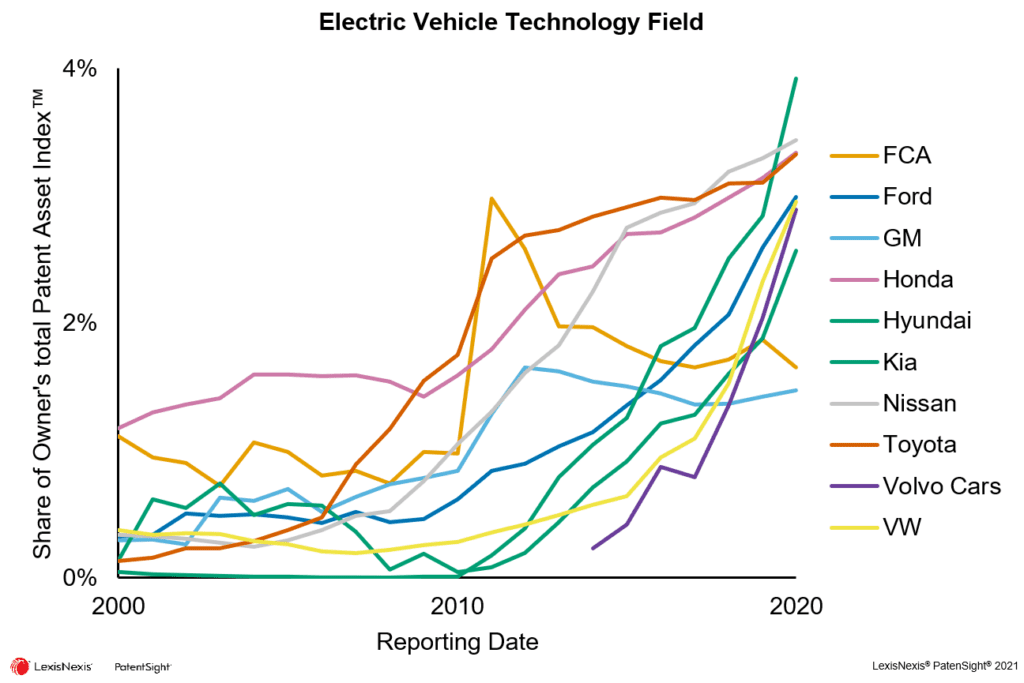

The chart shows the share of the patent owners’ total Patent Asset Index (portfolio strength) originating from the electric vehicle technology field. All car manufacturers show an increase in the last two decades, but they appear to be separated by a time gap of approximately six years: FCA, GM, Honda, Nissan, and Toyota had its steepest increase prior to about 2013. In contrast, since 2013 Ford, Kia, VW, Volvo, Hyundai steeply increase the electric vehicle technology share in their portfolio strength. Kia has the highest growth rate, which may have contributed to recent speculations that Kia may build the Apple Car.

Volvo Cars shows a steep increase in its overall portfolio strength originating from the electric vehicle technology field, not quite different for e.g. than the VW Group trend. If Volvo Cars maintains its growth rate, the goal of exclusively offering premium electric vehicles by 2030 appears, from an intellectual property perspective, not over-ambitious anymore; considering that Volvo Cars already sells a premium electric performance car under its Polestar brand.

Access articles from our e-mobility series:

- e-Mobility – Watch Out Traditional OEM’s!

- e-Mobility – Why is Knowing the Legal Status of Patents Important?

- e-Mobility Technology – Who Owns the Strongest Patent Portfolio?

- e-Mobility Technology – How to Predict the Portfolio of Your Competition

- e-Mobility Technology – Who’s Making It vs. Who’s Buying It?

- e-Mobility Technology – a Final Look at the Top Patent Owners

Learn more about PatentSight and the Patent Asset Index.