The Transformation into the New Takeda

William Mansfield

4/27/2018

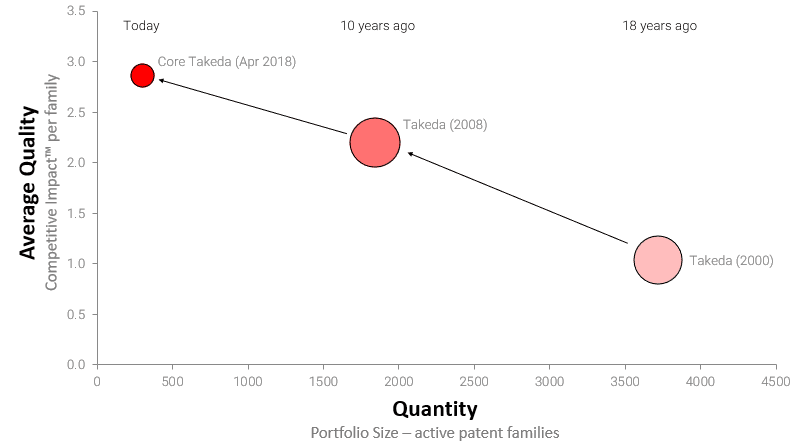

In 2011 faced with “the impending loss of patent protection on certain leading products”, the Takeda Pharmaceutical Company unveiled its mid-term plan to achieve sustainable growth. Over the 10 years prior to this the company had pruned its patent portfolio significantly from over 3500 patent families in the year 2000 to less than 1900 in 2008, saving the company millions of dollars over the lifetime of these patents. Whilst such cost-saving measures would have reduced the company’s liabilities, this alone would have not ensured long-term prosperity. Enter the “New Takeda”.

Core portfolio shrunk by 75% in 18 years

Development of “Core Takeda” patent portfolio, originally applied for by the company, excluding acquisitions.

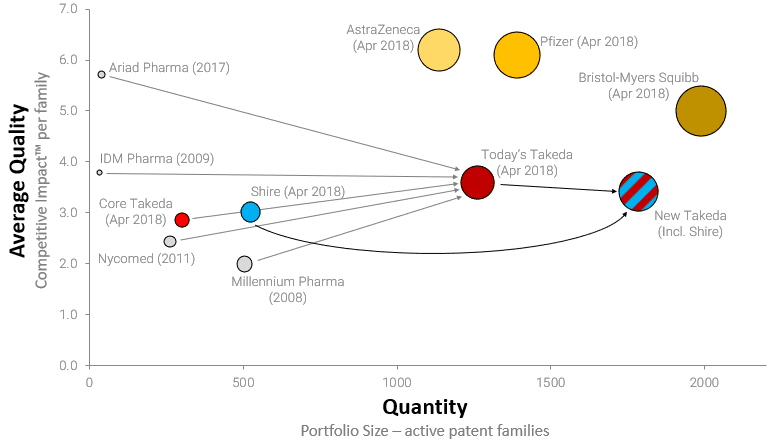

After already having a taste of acquisitions with the recent takeovers of IDM and Millennium Pharma, Takeda followed this with a spate of other acquisitions building both a wider-reaching company and a stronger innovation platform. The first New Takeda acquisition was Nycomed (in 2011) followed by URL Pharma (2012), Multilaba (2012), Ariad Pharma (2017) and TiGenix (2018). A number of these providing a significant boost to the company’s patent portfolio, but the biggest would be the recently discussed acquisition of Shire for €53bn.

Transformation into the New Takeda

Development of the New Takeda, separating portfolio of acquired companies from the “Core Takeda” portfolio. Related companies for reference (AstraZeneca, Pfizer & Bristol-Myers Squibb).

The contribution to the New Takeda which comes from patents originally applied for by the company, “Core Takeda”, is smaller than that from their two biggest acquisitions, Millennium and Shire (expected). Illustrating what a turning point this transition has been for the company. Through this process of carefully portfolio pruning and considered acquisition the company has transformed itself from a wilting flower to an IP powerhouse. In total, over the past 18 years, Takeda has lost or pruned 3000 patent families, changing their Competitive Impact from 1, the LexisNexis® PatentSight® database average, to 2.9. Whilst the acquisitions have increased the portfolio to around 1800 patent families further improving the Competitive Impact to 3.6.

With the field of Pharmaceuticals being dominated by big companies, Takeda’s acquisitions have turned a spate of fringe players into a contender in the international market. Only time will tell if the New Takeda will continue in its rise and challenge the giants of the industry, or if it will languish in its success.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: William Mansfield

William is the Head of Consulting and Customer Success for LexisNexis PatentSight. Responsible for overseeing the negotiation, creation, and delivery of PatentSight’s global consulting work along with managing the Customer Success team.