Billions to be Spent on Patent Renewals in 2021 and Beyond

William Mansfield

May 28, 2020

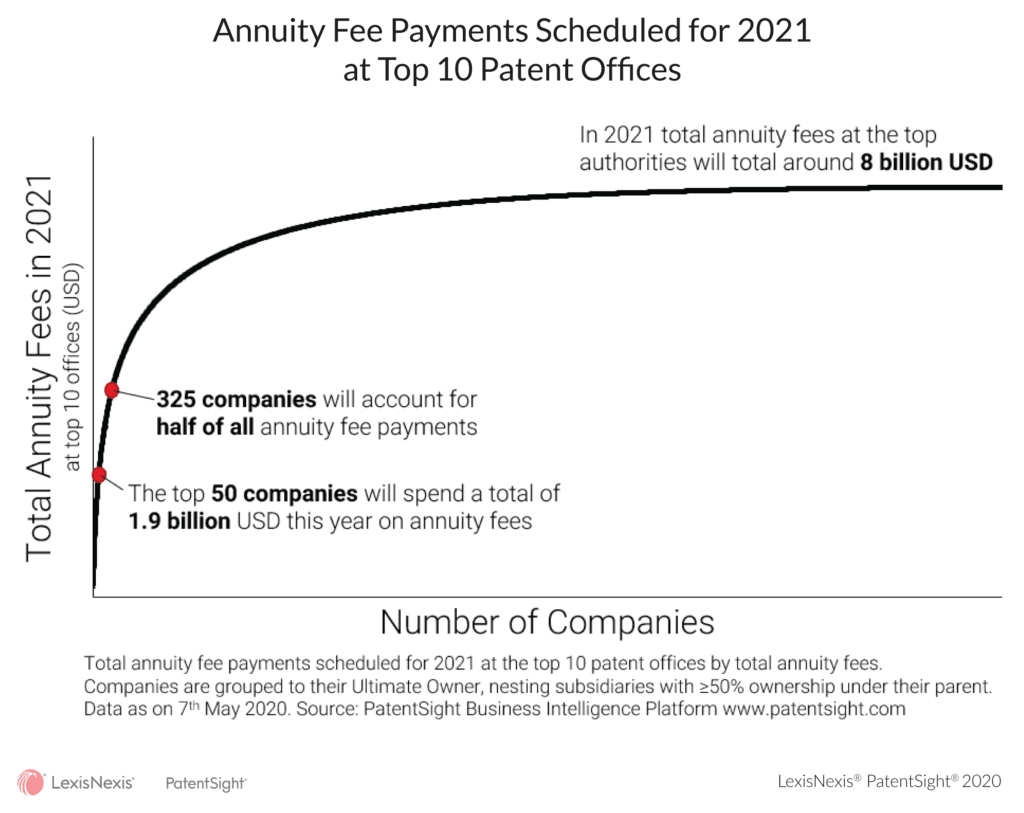

Around $8 billion is set to be spent this year on patent renewals, according to LexisNexis® PatentSight® annuity fees insights. That total, jumps to a staggering $184 billion due on all currently issued patents across the lifetime of those assets.

While some businesses that have significant licensing operations may have to double down on developing and managing their portfolios over the coming years, the vast majority of in-house functions that operate as cost centers might well find themselves coming under increased budgetary pressures should market conditions worsen.

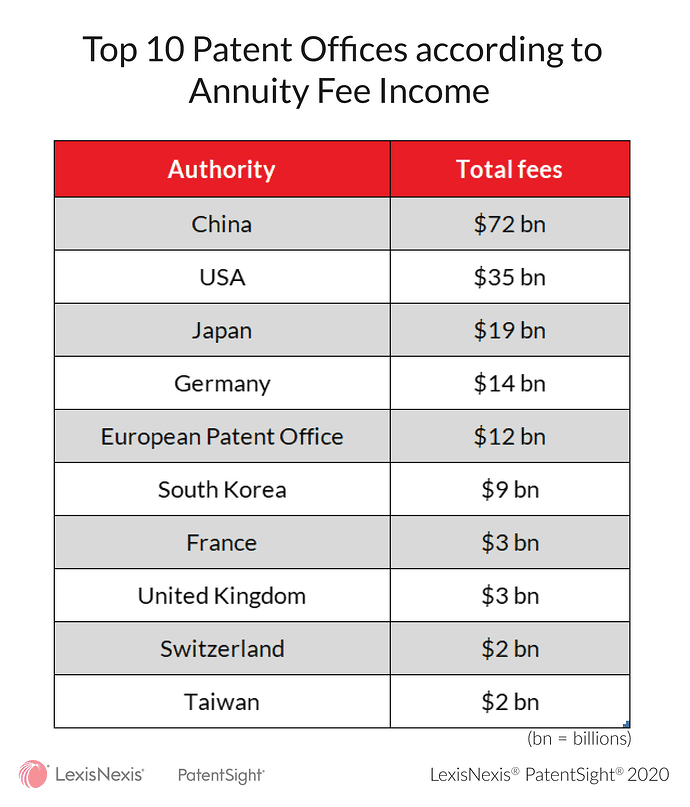

Using PatentSight® we broke down the numbers further to show which IP offices are set to receive the most fees over the lifetime of current grants.

The data shows the extent to which the explosion in patenting in China in recent years has also handed a potentially huge payoff to the country’s IP agency. Should all of the fees be paid on the currently active Chinese patents over their lifetimes then CNIPA will bring in more than double the USPTO.

The top two patent offices, USPTO and CNIPA, account for 50% of all fees, and if we take the top 10 patent offices they account for 90%.

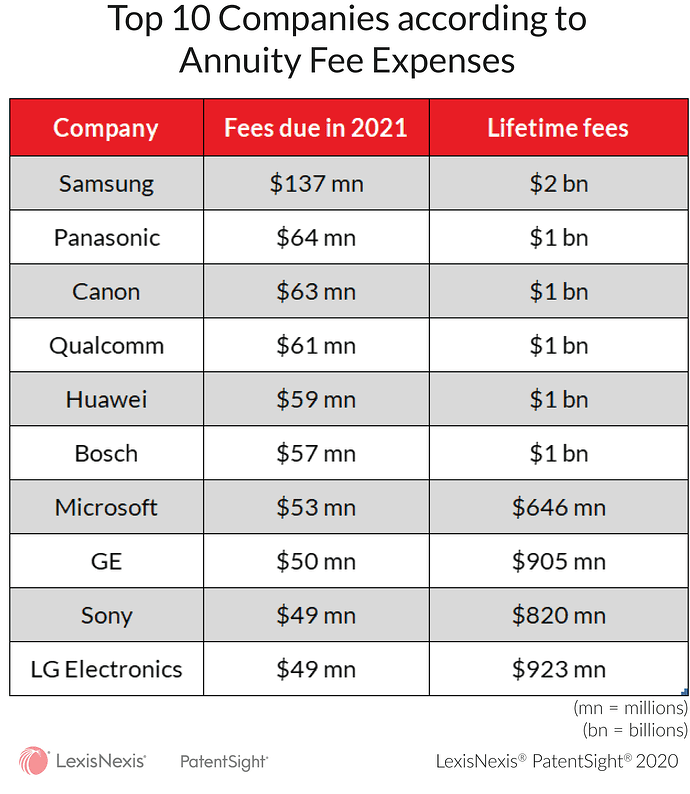

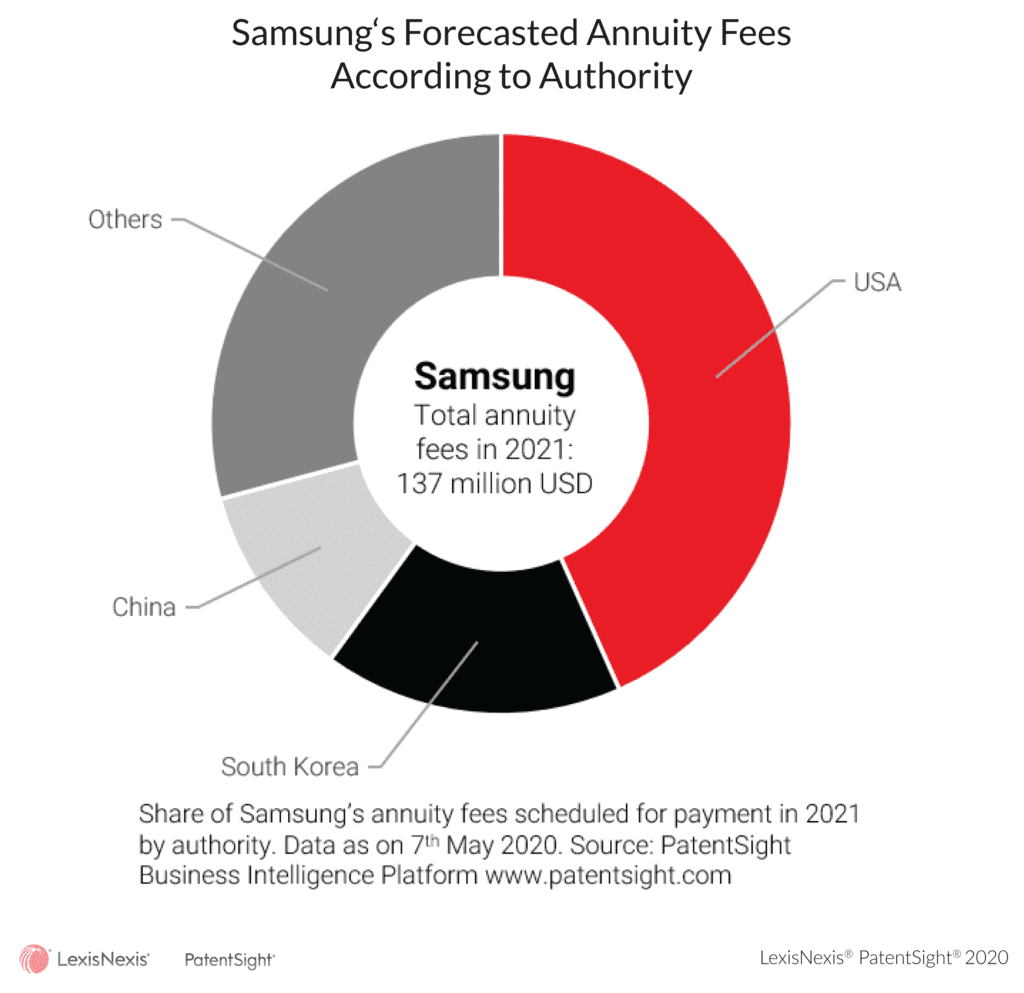

That concentration at the top of the market is also reflected in the companies that are facing the largest potential maintenance fee bills. The number of patent-holding entities globally runs into the seven-digit range, however of these 325 are responsible for 50% of all annuity fee payments. Of those, it’s Samsung that leads the way – by a wide margin.

Here are the top 10 companies ranked by the fees they’re set to pay this year, with additional data on how much they’re due to shell out on patent renewals over the lifetime of their current portfolios:

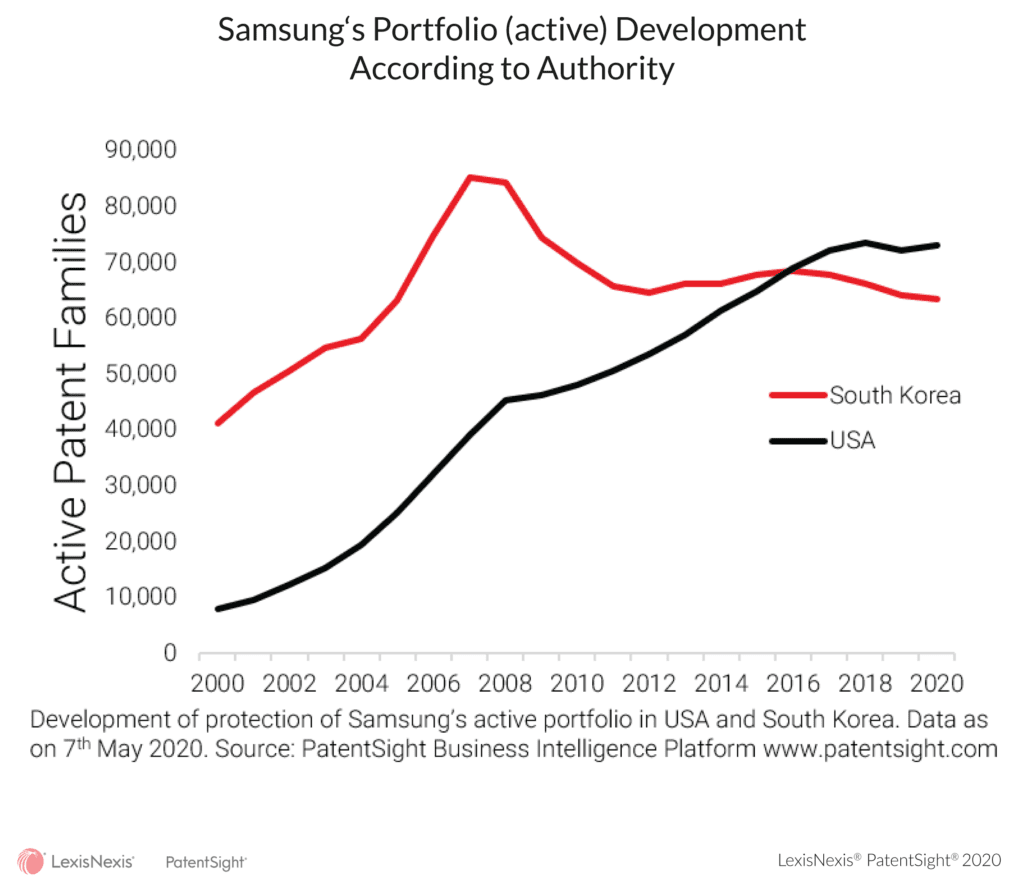

This concentration leads to an interesting dynamic in the global patent market. It creates a kind of symbiotic relationship between the top patent offices and the top patent owners, where the patent offices are reliant on the top set of owners, and the owners need to file at these offices. This is weighted on the side of those owners who are more reliant on specific patent offices, however, this can change. Samsung for example, files and spends much more in the US than in its home country of South Korea, but this has not always been the case. It has only been since 2016 that Samsung’s US portfolio has been larger than its portfolio of South Korean patents, so whilst companies are often dependent on a set of patent offices there can still be significant movement between them.

So the data shows that even with a relatively small pruning of their portfolios, most companies could save millions on patent renewals with the ax possibly falling on a company’s lowest quality assets.

According to our Patent Asset Index Competitive Impact quality metric, of active US grants 1.7 million are above average, with 1.3 million below average. The majority of the fee payments at the USPTO go to continuing above-average patents, however, these below-average patents still contribute to a huge, potentially not required, expense. They will cost $900 million in 2021 and $15 billion over their lifetime, so if even just a small percentage of these were pruned it would result in huge cost savings.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: William Mansfield

William is the Head of Consulting and Customer Success for LexisNexis PatentSight. Responsible for overseeing the negotiation, creation, and delivery of PatentSight’s global consulting work along with managing the Customer Success team.