Patent Analysis Around the Bristol-Myers Squibb/Celgene Merger

William Mansfield

February 25, 2019

In January of this year, U.S. pharmaceutical manufacturers Bristol-Myers Squibb (BMS) and Celgene Corporation announced they had entered into a definitive merger agreement for BMS to acquire Celgene.

The stated aim of the merger is to create ‘a premier innovative biopharma company’ with a particular focus on building an expanded offering in the cancer and immunotherapy space. If completed, the transaction is expected to cost $74 billion in a cash and stock deal, whereby Celgene shareholders will receive 1.0 BMS share as well as $50 in cash for each share of Celgene.

Our analysis of the two firms’ respective patent portfolios provides insight into how this merger would affect the U.S. pharma market. For this analysis, we employed our LexisNexis® PatentSight® Patent Asset Index methodology, which scientifically assesses patent families against Key Performance Indicators of Technology Relevance and Market Coverage.

Assessing the firms’ patent families

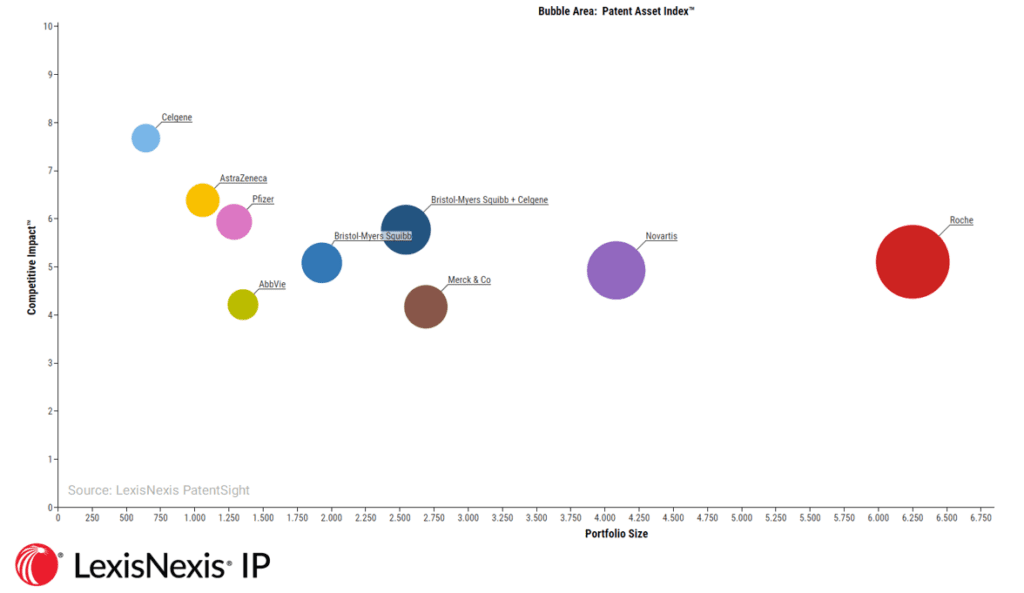

Our analysis suggests that while Celgene currently only maintains a relatively small volume of patents, they are high-quality and deliver a strong competitive impact. Bristol-Myers Squibb, meanwhile, maintains a significantly larger portfolio of active patent assets, although these are of a relatively lower competitive value – but still well above the global average. Combined, the merged firm’s portfolio would increase significantly in market competitiveness, and marginally in volume. This would be in line with a wider trend in the pharma market, where the R&D efforts of major manufacturers are increasingly focused on innovation quality over quantity.

Merger Scenario: Bristol-Myers Sqibb acquiring Celgene (announced for 2019)

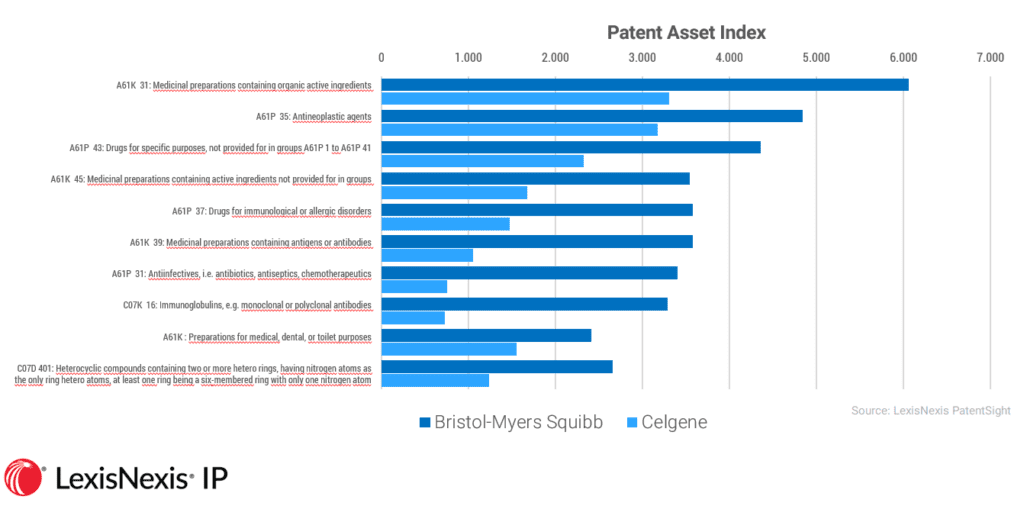

Technology overlaps underscore potential concerns

When we drill down into specific technologies, the picture becomes much more interesting – and potentially troubling. One of the key technology overlaps between BMS and Celgene is in the area of antineoplastic agents: complex treatments that act to prevent, inhibit or halt the development of cancerous tumors. This is also the area flagged by BMS and Celgene as key to its merger plans.

Technology overlap between Bristol-Myers Squibb and Celgene

When it comes to anti-cancer treatments, the combined strength of the two companies is proving to be a cause for concern. In January, two U.S. congressmen wrote to the Federal Trade Commission (FTC) and the Department of Justice (DoJ) stating that the merger could diminish competition and reduce patent options in specific treatment areas. This is a new area for the FTC, which has not previously examined the market impact of M&As on complimentary drugs, causing the potential for suppliers to create so called ‘rebate walls’.

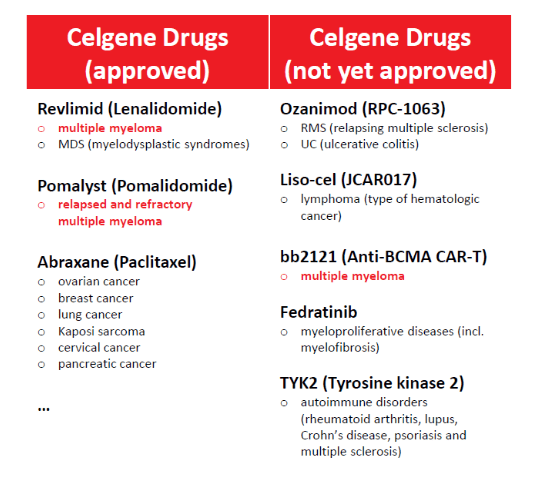

The letter to the FTC highlighted three drugs of particular interest, and statements from Bristol-Myers Squibb on the acquisition also note a handful of specific drugs which high potential returns. Interestingly, three of these eight drugs cover treatment of Multiple Myeloma: a type of cancer that affects plasma cells and which is reported by Myeloma UK to account for 2% of all new cancers:

Celgene drugs that cover the treatment of Multiple Myeloma

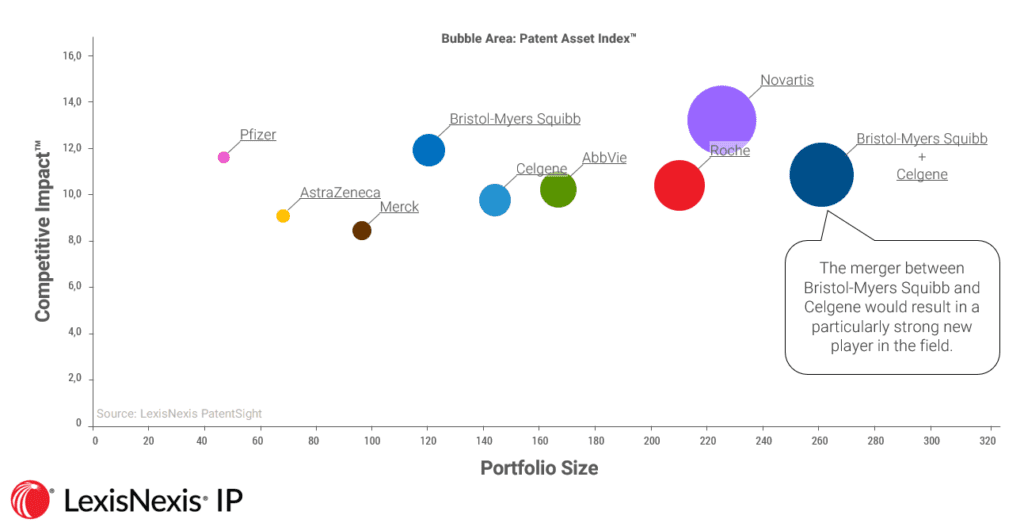

When we apply the Patent Asset Index analysis to this specific area of focus for the two firm’s R&D, we find that the companied company would leapfrog its competitors; going from a mid-range player to become overall market leader in terms of high quality/quantity patents. Moreover, according to BMS’ own analysis from its merger statement to shareholders, the drugs Celgene currently has in late-stage development have a revenue potential of $15 billion for the company.

Competitive Landscape of Multiple Myeloma Treatment

Patent analysis increasingly important in M&A oversight

As we saw in the merger between Dow Chemical and Dupont in 2017, regulators are increasingly keen to ensure that mergers do not adversely affect competition, prices or product lines. In the case of Dow/DuPont, the EU Commission instructed PatentSight to conduct a patent analysis of the two firms. Based on our findings, the merger was only approved on condition that DuPont divest most of its global pesticide business, including its corresponding R&D organization.

Only time will tell whether the DOJ and FTC believe the BMS/Celgene merger raises anti-trust issues, but one thing is certain: patent portfolios are coming under increased scrutiny by law-makers and regulators during significant mergers.

Learn more about PatentSight and the Patent Asset Index.

See how to monitor competitors’ portfolio strengths and developments with PatentSight benchmarking.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: William Mansfield

William is the Head of Consulting and Customer Success for LexisNexis PatentSight. Responsible for overseeing the negotiation, creation, and delivery of PatentSight’s global consulting work along with managing the Customer Success team.