How is China’s Rapid Growth in Aviation Impacting International Players?

With the world’s second-largest economy and a population of over 1.4 billion people, China’s impact on global market forces is undeniable. The fast expansion is driven primarily by economic growth and increased disposable income for the Chinese middle class. According to the International Air Transport Association (IATA), China’s domestic passenger traffic has increased by an average of 10.5% annually over the past decade, making it one of the fastest-growing markets in the world. In 2019, China officially surpassed the United States to become the largest aviation market in terms of passenger numbers. This raises the question, how is this growth impacting traditionally dominant players in the aviation industry?

Using patent analytics to study China’s booming aviation industry

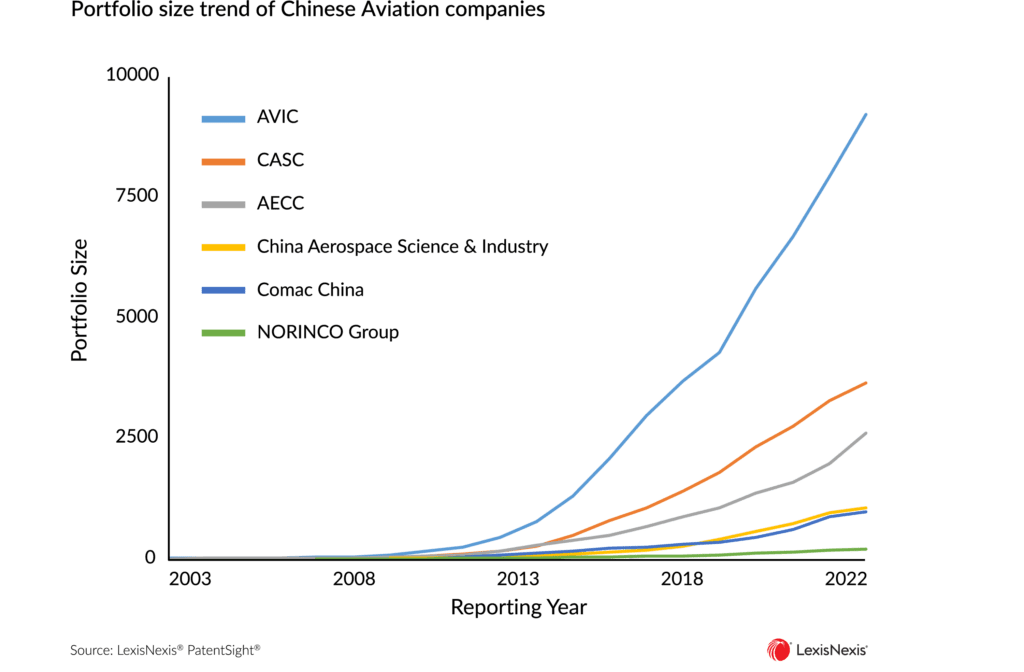

There are few unbiased information sources on what companies are really working on and plan to bring to market. Patents, however, offer a unique window into the R&D efforts and future products of these companies since they require the disclosure of the technology they protect and are often published many years before the corresponding commercial products hit the market. This makes metrics based on patent data objective and forward-looking. Using patent analytics to shed light on the current state of innovation at Chinese aviation companies, we can see in the chart below, these innovators have rapidly increased their patent holdings in the last decade.

This chart indicates that Chinese aviation companies are investing heavily in research and development and positioning themselves as major players in the industry. Chinese-made planes are already seeing commercial interest, with China’s Comac (Commercial Aircraft Corporation of China) claiming to have received orders for more than 1200 of their C919 aircraft. This model competes domestically with the wildly successful international players’ models like the Airbus A320neo (EU) and the Boeing 737 Max (US).

Patent data points to gaps in the international players’ intellectual property strategies in China

Despite the clear market growth and increased innovation, many legacy aviation companies are not yet fully engaged in the Chinese market. One reason for this lack of engagement is evident from the low intellectual property (IP) filings in China by these companies. Since most international aviation companies haven’t considered Chinese counterparts as real threats to their business. But as foreign companies participate in the Chinese aviation market, they are also operating service and maintenance centers that employ and train local talent who can in turn leave with all that knowledge and join a homegrown aviation company. Preventing this is impossible, and overlooking IP protection in China can lead to local players freely learning about technology via patent filings elsewhere and implementing these without restriction in the domestic Chinese market.

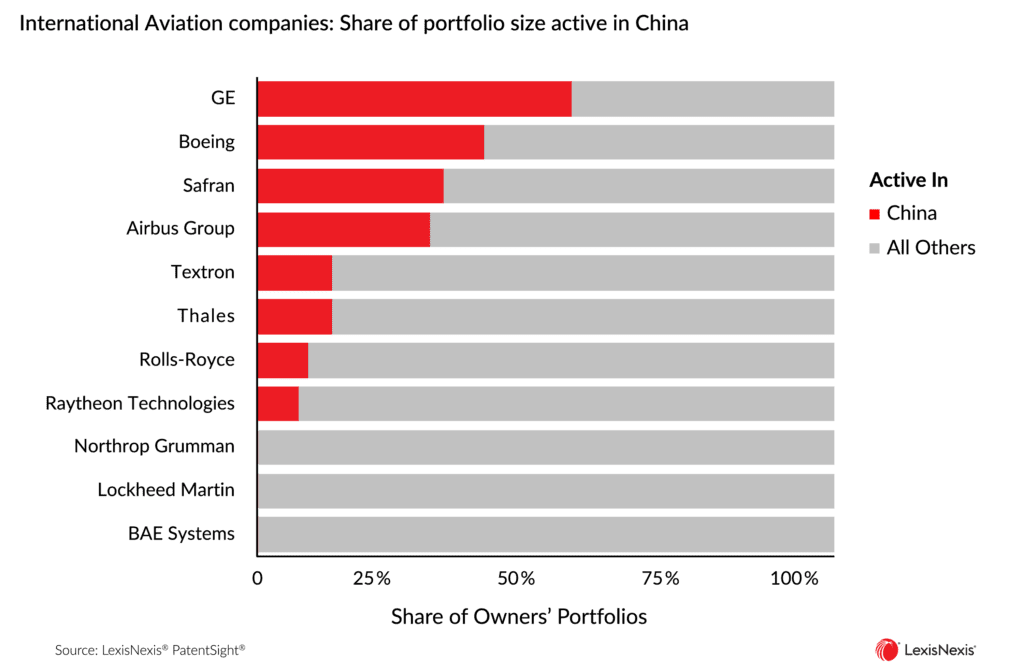

Our analysis with LexisNexis® PatentSight®, which enables us to segment by portfolios active in a specific region, shows that GE (leading aviation engine supplier) and Boeing are the only companies with a reasonable share of their patent portfolio protected in China. Airbus, Boeing’s traditional competitor, has also protected a good percentage of its portfolio in the region.

The most significant finding is that Rolls-Royce, the traditional competitor for GE and Safran, only has 10% of its portfolio protected in China. Given that Rolls-Royce is known for its preventive maintenance technologies, its current IP filing strategy might not be able to prevent any proliferation of its IP in China. This is technology that took likely many millions in research, that is currently up for grabs in the Chinese aviation market and poses a significant threat, or at the least, a missed opportunity for Rolls-Royce.

What does collaboration look like between Chinese and international innovators?

Traditional market leaders in aviation need to adapt to the challenges and opportunities presented by the changing landscape of the Chinese aviation industry to stay ahead of the game. This means not only engaging with the Chinese market but also collaborating with Chinese companies on research and development. For example, Airbus has established a joint venture with China’s AVIC (Aviation Industry Corporation of China) to manufacture and assemble A320 family aircraft in China. Similarly, Boeing has partnered with Chinese aviation companies on research and development projects.

Licensing deals are also an opportunity for international companies to engage with their Chinese counterparts. But, to do this they would need to have first filed their patents in China and prior to Chinese companies. The same data used to pull the patent analyses in this article can help aviation innovators not only identify potential licensees but help determine their leverageable position.

Collaborations between international and Chinese players have already yielded positive results. In 2017, Airbus signed a deal to sell 140 aircraft to China, worth an estimated $22.8 billion. In 2018, Boeing signed a memorandum of understanding with Comac to explore areas of cooperation in commercial aviation. These collaborations not only provide international companies with access to the Chinese market but also enable them to tap into the expertise and resources of Chinese players.

Chinese skies are calling: are aviation players listening?

Chinese aviation market is rapidly growing, and international players must engage if they do not want to be left behind. Homegrown aviation companies from China are building up a formidable portfolio of inventions in this technology space. Whether via research partnerships or directly entering the market to protect their inventions, international players need to act in response to the advancements made by their Chinese counterparts. With the right approach, aviation innovators can benefit from the opportunities this growing market presents.

Patent insights to guide the approach

Engaging with a market force without performing due diligence can be risky. This is an area that patent analytics has revolutionized. The European Commission even uses patent analytics to evaluate M&A deals before they are approved. From experience working with some of the pioneers in innovation across the world, we understand that successfully entering a market requires extensive research, including benchmarking your technology against other industry leaders, spotting gaps in your R&D strategy that can be resolved with an acquisition, etc. Insights from patent analytics can significantly reduce risks for international companies trying to make an impact in China and help them be more precise with their strategies.

Do not miss our follow-up blog, where we will be taking a closer look at the patent portfolios of the most prominent aviation players in China like Comac, China Aerospace Science and Technology Corporation (CASC), Aviation Industry Corporation of China (AVIC), etc. and compare them against the portfolios of their international counterparts like GE, Boeing, Rolls Royce, etc. Subscribe to our newsletter or follow us on social to stay up-to-date on these incredible analyses and insights.

Want to better understand China’s increasing dominance across the Engineering industry?

Download our Engineering intellectual property report, where data reveals clear trends about the future of Engineering and how international players are reacting to the growing Chinese influence.

Get insights into different Engineering sectors, including Aviation, Energy, Manufacturing Equipment, Railway and Ship Building, Civil Engineering, and more.